The Most Effective Countries for Offshore Investment and Their Economic Advantages

The Most Effective Countries for Offshore Investment and Their Economic Advantages

Blog Article

The Top Factors for Thinking About Offshore Investment in Today's Economic situation

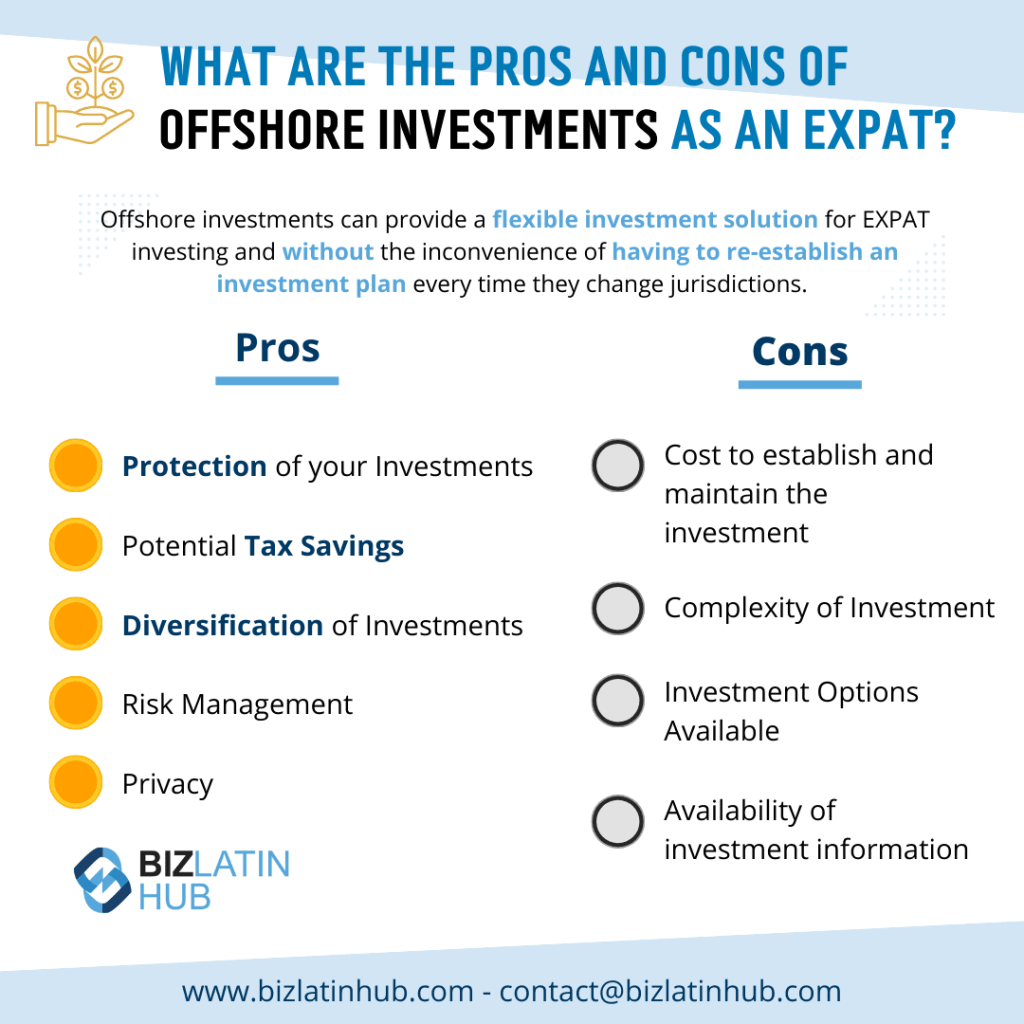

In the context of today's unpredictable financial landscape, the values of offshore investment warrant careful consideration. What certain benefits could offshore financial investments bring to your profile in the current climate?

Diversification of Investment Portfolio

One of the main factors financiers think about offshore financial investments is the opportunity for diversification of their financial investment portfolio. By allocating possessions across different geographical areas and markets, investors can reduce risks connected with concentrated investments in their home nation. This strategy is specifically beneficial in an increasingly interconnected global economy, where financial recessions can have localized effects.

Offshore financial investments allow individuals to tap into arising markets, fields, and money that might not be easily accessible with domestic avenues. Because of this, capitalists can potentially benefit from distinct development opportunities and bush against volatility in their local markets. Branching out into international possessions can reduce direct exposure to domestic financial changes, interest price modifications, and political instability.

In enhancement to geographical diversity, offshore financial investments typically encompass a range of asset classes, such as supplies, bonds, realty, and different investments. This multifaceted approach can boost risk-adjusted returns and offer a barrier against market declines. Ultimately, the mix of international direct exposure and varied possession courses positions capitalists to achieve lasting monetary goals while navigating the intricacies of worldwide markets.

Tax Obligation Benefits and Cost Savings

Offshore financial investments likewise supply significant tax advantages and savings, making them an eye-catching option for financiers looking for to maximize their economic methods. Many jurisdictions supply desirable tax obligation treatment, allowing financiers to reduce their total tax obligations. For example, certain offshore accounts might enable tax deferment on resources gains till withdrawals are made, which can be advantageous for long-term investment growth.

Additionally, offshore structures can assist in estate preparation, enabling people to move wide range efficiently while minimizing estate tax. By making use of trust funds or various other lorries, capitalists can shield their properties from too much taxation and guarantee smoother transitions for future generations.

Additionally, some offshore territories impose little to no revenue tax, giving possibilities for higher returns on investment. This can be specifically beneficial for high-net-worth individuals and corporations looking to optimize their funding.

Access to International Markets

Additionally, spending offshore supplies an one-of-a-kind opportunity to purchase industries and markets that are growing in various areas. For example, technological improvements in Asia or renewable resource campaigns in Europe can offer profitable financial investment alternatives. This geographic diversity not only minimizes dependence on residential financial cycles yet also reduces risks connected with localized slumps.

In addition, overseas financial investment systems usually provide investors with a wider range of financial link instruments, consisting of international supplies, bonds, common funds, and different possessions. Such a range allows financiers to tailor their profiles according to their danger resistance and financial investment purposes, improving general portfolio resilience.

Enhanced Financial Privacy

While maintaining economic personal privacy can be challenging in today's interconnected world, overseas financial investment methods use a considerable advantage hereof. Several capitalists seek to protect their financial info from analysis, and offshore jurisdictions offer legal structures that support privacy.

Offshore accounts and investment vehicles often feature robust privacy regulations that limit the disclosure of account details. This is specifically valuable for click here now high-net-worth individuals and businesses aiming to secure sensitive economic data from undesirable interest. Many territories also supply strong property security procedures, making certain that possessions are secured from prospective lawful disagreements or financial institutions.

Additionally, the complexities surrounding global financial laws usually indicate that details shared between territories is minimal, additional boosting privacy. Capitalists can take advantage of numerous offshore structures, such as trust funds or limited collaborations, which can use additional layers of privacy and security.

It is critical, however, for financiers to adhere to applicable tax legislations and regulations in their home countries when using overseas financial investments. By thoroughly navigating these demands, people can enjoy the benefits of improved monetary personal privacy while sticking to lawful responsibilities. Generally, offshore investment can function as a powerful device for those looking for discernment in their financial affairs.

Security Against Financial Instability

Numerous financiers acknowledge the relevance of safeguarding their properties against economic instability, and offshore investments provide a sensible solution to this concern (Offshore Investment). As international markets experience fluctuations due to political stress, rising cost of living, and uncertain financial plans, expanding investments across borders can mitigate risk and enhance portfolio strength

The diversity offered by overseas investments also enables access to arising markets click now with development capacity, permitting critical positioning in economies much less influenced by global uncertainties. Therefore, investors can stabilize their profiles with assets that may do well throughout residential economic slumps.

Verdict

To conclude, the factor to consider of overseas financial investment in the contemporary economic climate provides many benefits. Diversity of financial investment profiles minimizes threats related to residential variations, while tax obligation advantages improve general returns. Access to worldwide markets opens opportunities for growth, and improved monetary privacy safeguards assets. Additionally, offshore investments provide important security against economic instability, equipping investors with critical placing to successfully browse unpredictabilities. Overall, the merits of overseas investment are significant and warrant mindful factor to consider.

One of the main factors financiers consider overseas investments is the opportunity for diversity of their financial investment portfolio.In addition to geographical diversification, overseas investments often incorporate a range of property classes, such as stocks, bonds, actual estate, and alternate financial investments.Offshore financial investments also provide substantial tax advantages and cost savings, making them an attractive option for capitalists seeking to enhance their economic strategies.Access to international markets is a compelling benefit of offshore investment methods that can significantly enhance a capitalist's portfolio.Offshore investment choices, such as international real estate, worldwide common funds, and international currency accounts, enable financiers to shield their properties from regional economic declines.

Report this page